Where Does Home Office Deduction Go On 1040 . Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. » need to back up? Home office deduction at a glance. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. If you use part of your home exclusively and regularly for conducting business, you may be.

from classdbmarshall.z13.web.core.windows.net

The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. » need to back up? Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. Home office deduction at a glance. If you use part of your home exclusively and regularly for conducting business, you may be.

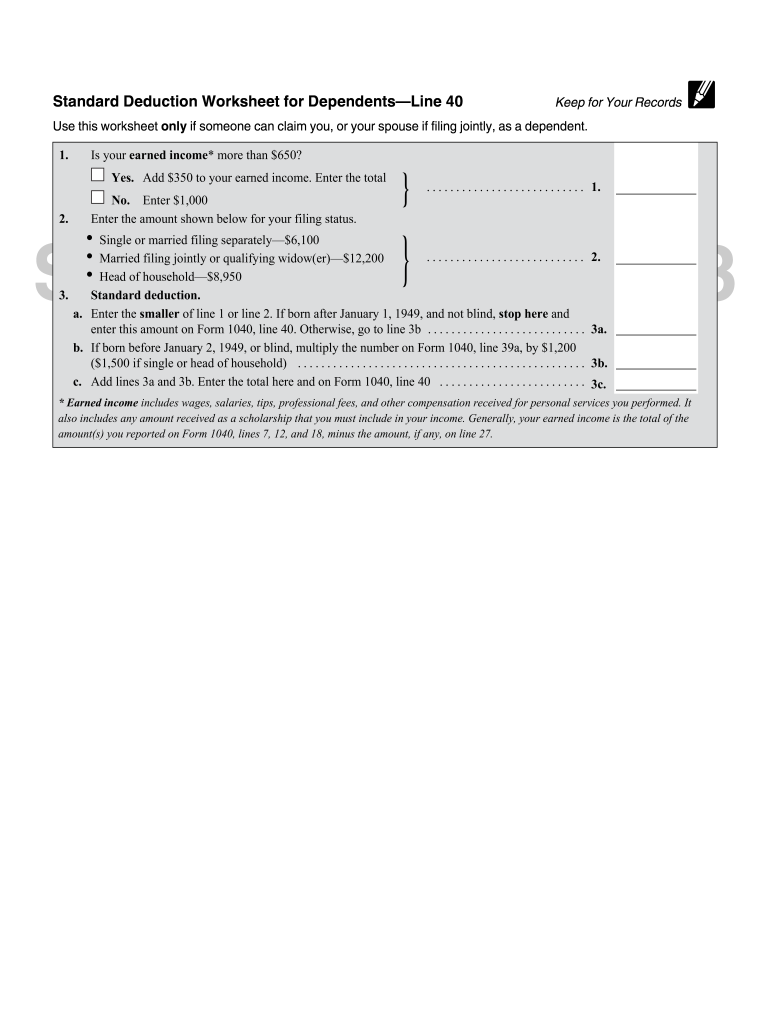

Irs Worksheet For Determining Support 2021

Where Does Home Office Deduction Go On 1040 Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). If you use part of your home exclusively and regularly for conducting business, you may be. Home office deduction at a glance. Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. The home office deduction is computed by categorizing the direct vs. » need to back up? Indirect business expenses of operating the home and allocating them on form 8829, expenses for business.

From www.iota-finance.com

Saving on taxes using the home office deduction Where Does Home Office Deduction Go On 1040 » need to back up? Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. If you use part of your home exclusively and regularly for conducting business, you may be. The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them. Where Does Home Office Deduction Go On 1040.

From www.everycrsreport.com

The Home Office Tax Deduction Where Does Home Office Deduction Go On 1040 » need to back up? The home office deduction is computed by categorizing the direct vs. Home office deduction at a glance. Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. If you use part of your home exclusively and regularly for conducting business, you may be. Indirect business expenses of. Where Does Home Office Deduction Go On 1040.

From www.taxsavingspodcast.com

How Does the Home Office Deduction Work? Where Does Home Office Deduction Go On 1040 Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. » need to back up? Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. If you use part of your home exclusively and regularly for conducting business, you may be. The home office deduction is. Where Does Home Office Deduction Go On 1040.

From davidphen1963.blogspot.com

Irs 1040 Form / Tax Tuesday Are You Ready To File The New Irs 1040 Form Where Does Home Office Deduction Go On 1040 Home office deduction at a glance. The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. If you use part of your home exclusively and regularly for conducting business, you may be. » need to back up? The home office tax deduction can. Where Does Home Office Deduction Go On 1040.

From form-8829.com

simplified home office deduction 2018 Fill Online, Printable Where Does Home Office Deduction Go On 1040 The home office deduction is computed by categorizing the direct vs. Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). Home office deduction at a glance. » need to back up? If you use. Where Does Home Office Deduction Go On 1040.

From www.stkittsvilla.com

Deducting Your Home Office San Go Tax Preparation Where Does Home Office Deduction Go On 1040 Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. Home office deduction at a glance. If you use part of your home exclusively and regularly for conducting business, you may be. The home office deduction is computed by categorizing the direct vs. The home office tax deduction can be taken on. Where Does Home Office Deduction Go On 1040.

From www.fmtrustonline.com

How to Calculate Home Office Deductions F&M Trust Where Does Home Office Deduction Go On 1040 » need to back up? The home office deduction is computed by categorizing the direct vs. If you use part of your home exclusively and regularly for conducting business, you may be. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). Home office deduction at a glance. Deductions attributable to the home. Where Does Home Office Deduction Go On 1040.

From cjdfintech.com

Maximize Your Savings Unraveling the Benefits of the Home Office Tax Where Does Home Office Deduction Go On 1040 The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). If you use part of your home exclusively and regularly for conducting business, you may be. » need to back up? Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. Home office deduction at. Where Does Home Office Deduction Go On 1040.

From www.dreamstime.com

Home Office Tax Deduction Information on Laptop Screen. Stock Photo Where Does Home Office Deduction Go On 1040 Home office deduction at a glance. The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. » need to back up? If you use part of your home exclusively and regularly for conducting business, you may be. Deductions attributable to the home that. Where Does Home Office Deduction Go On 1040.

From virblife.com

Can You Take a Home Office Tax Deduction? Where Does Home Office Deduction Go On 1040 » need to back up? Home office deduction at a glance. If you use part of your home exclusively and regularly for conducting business, you may be. The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. The home office tax deduction can. Where Does Home Office Deduction Go On 1040.

From classdbmarshall.z13.web.core.windows.net

Irs Worksheet For Determining Support 2021 Where Does Home Office Deduction Go On 1040 Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. Home office deduction at a glance. The home office deduction is computed by categorizing the direct vs. If you use part of your home exclusively and regularly for conducting business, you may be. The home office tax deduction can be taken on. Where Does Home Office Deduction Go On 1040.

From wesuregroup.com

Home Office Tax Deduction Tips for Small Business Owners Where Does Home Office Deduction Go On 1040 Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. » need to back up? Home office deduction at a glance. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). Indirect business expenses of operating the home and allocating them on form 8829, expenses. Where Does Home Office Deduction Go On 1040.

From www.stkittsvilla.com

Your Home Office Tax Deductions For Small Business Where Does Home Office Deduction Go On 1040 Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses. Where Does Home Office Deduction Go On 1040.

From www.marketwatch.com

Meet the smaller — but not necessarily easier — IRS 1040 tax Where Does Home Office Deduction Go On 1040 Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). Home office deduction at a glance. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. » need to. Where Does Home Office Deduction Go On 1040.

From davida.davivienda.com

Home Office Deduction Worksheet Excel Printable Word Searches Where Does Home Office Deduction Go On 1040 The home office deduction is computed by categorizing the direct vs. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). » need to back up? If you use part of your home exclusively and regularly for conducting business, you may be. Indirect business expenses of operating the home and allocating them on. Where Does Home Office Deduction Go On 1040.

From 1044form.com

5 Popular Itemized Deductions 2021 Tax Forms 1040 Printable Where Does Home Office Deduction Go On 1040 Deductions attributable to the home that are otherwise allowable without regard to business use (such as qualified residence. If you use part of your home exclusively and regularly for conducting business, you may be. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). Indirect business expenses of operating the home and allocating. Where Does Home Office Deduction Go On 1040.

From www.exceptionaltaxservices.com

Save Big Time On Taxes How To Do Your Home Office Deduction Right Where Does Home Office Deduction Go On 1040 The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. If you use part of your home exclusively and regularly for conducting business, you may be. Home office deduction at a glance. The home office deduction is. Where Does Home Office Deduction Go On 1040.

From lyfeaccounting.com

Home Office Deduction Explained Write Off & Save on Taxes Where Does Home Office Deduction Go On 1040 The home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. Home office deduction at a glance. The home office tax deduction can be taken on schedule c of form 1040 (annual tax return). If you use part of your home exclusively and regularly. Where Does Home Office Deduction Go On 1040.